Pan Card

The full form of PAN is the Permanent Account Number. It is a system for identifying different types of taxpayers across the country. PAN is a 10-digit alphanumeric number (including both letter and number) given to Indians, mostly those who pay any taxes. The PAN system of identifying is a computer-based program that provides each Indian taxpaying entity with a unique identification number. All tax-related details for an individual are collected using this system, which uses a specific PAN number as the main key for information of storage. Because this information is shared across the country, no two persons who pay the tax can have the same PAN.

When an entity is assigned a PAN, the Income Tax Department also issues a PAN Card. PAN Card is a tangible card containing your PAN, name, birthdate, and image. Photocopies of this card can be used to prove your identification or date of birth.

There are two main ways to apply for a PAN card. There's an offline and online process. Since we're here to guide you more easily, we will showcase by which you can apply for a PAN card online.

TYPES OF A PAN CARD

There are different types of PAN cards available, each with its own set of uses, as detailed below:

1. PAN card for organizations and companies

2. PAN card for Cooperative Societies and Trusts

3. PAN card for Individual taxpayers

4. PAN card for business units or partnership firms

Eligibility of a PAN Card

According to the 139A of the Income Tax Act, Indian residents who fall into the following categories are eligible for a PAN card:

- Self-employed professionals or company owners with annual revenue of at least Rs. 5 lakh.

- Individuals who are liable to pay tax or who have paid tax.

- Individuals involved in the import and export of goods

- Associations, organizations, and trusts that have been registered

NRIs (Non-Resident Indians), PIOs (Persons of Indian Origin), OCIs (Overseas Citizens of India), cardholders, and foreigners who fall under the Income Tax Act of 1961 are also eligible to apply for a PAN card. Parents can also apply for a PAN card on behalf of their underage children.

Eligibility of a PAN Card

According to the 139A of the Income Tax Act, Indian residents who fall into the following categories are eligible for a PAN card:

- Self-employed professionals or company owners with annual revenue of at least Rs. 5 lakh.

- Individuals who are liable to pay tax or who have paid tax.

- Individuals involved in the import and export of goods

- Associations, organizations, and trusts that have been registered

NRIs (Non-Resident Indians), PIOs (Persons of Indian Origin), OCIs (Overseas Citizens of India), cardholders, and foreigners who fall under the Income Tax Act of 1961 are also eligible to apply for a PAN card. Parents can also apply for a PAN card on behalf of their underage children.

Benefits of the PAN Card

1. Valid Identity Proof – The PAN Card contains information such as a person's name, age, and image, it can be used as proof of identity almost anywhere in the nation.

2. Work as a Tracker - The best approach to maintain track of your tax payments is to use a PAN. Otherwise, because your tax payment cannot be verified, you may be obliged to pay it many times. .

3. Utility Connection - Electricity, telephone, LPG, and internet connections can all be obtained with a PAN Card. .

4.IT Returns Filing: All individuals and entities who are eligible for income tax are expected to file their IT RETURNS. A PAN card is necessary to fill IT Returns ad is the primary reason, as well as other entities, apply for more.

5. Tax deduction: A person or entity must get their pan card because, if a PAN card is not linked with a bank account and the annual earning and saving deposits is more than 10,000/- then the bank would deduct 30% TDS instead of 10%. .

6. Starting a Business: In process of starting a business a company or any other entity mandatory needs to have a PAN registered in the name of its entity. Tax Registration Number (TRN) is for a business that is obtained only if the entity has a PAN.

7. Identity Proof: PAN card serves as valid identity proof. Other than voter card, Aadhar card. PAN card is also accepted by all financial institutions and all other organizations as identity proof .

8. Opening a Bank account: All public, private and cooperative banks have made it mandatorily for an individual or a company to have a bank account in its name to open a saving or current account only under Pradhan Mantri Jan Dhan Yojana, a person can open a zero-balance account by using voter card or Aadhar card. .

9.Claiming Income tax Return: -In case, the TDS deducted from a taxpayer’s income is more than the actual tax that he is supposed to pay. To claim the excess tax paid, the taxpayer has to have a PAN linked to his bank account.

10. Opening Demat Account: - PAN Card is mandatory for an individual or entity to open a Demat Account, which is needed to hold shares in dematerialized form.

11. Purchase and sale of Immovable Assets: - while making a sale and purchase of immovable assets having a threshold of above 10 lakhs rupees there is a need for a PAN card. which make an individual eligible to enter into transactions of sale or purchases of assets.

12. Time Deposit: - Deposits with post office, co-operative banks, non-banking financial companies, will also need PAN, deposits adding up to Rs.5 lakh or more every year will require PAN.

13. Foreign Travel: - Cash payment related to foreign travel of an amount more than Rs. 50,000/- inclusive of forex purchases require a PAN card.

14. Bank Draft, pay Orders ad Banker’s cheque: - PAN is needed for Bank Draft, Pay Orders ad Banker’s Cheque with a transaction of more than Rs 50000/-. This implies that transactions more than 50000/- will only need a PAN Card

15. Cash Cards and Pre-Paid instruments: - Cash Payment adding up to more than Rs.50000/- per year will need PAN to be furnished.

Documents Required for a PAN Card

There is an exhaustive list of documents required to obtain a PAN card, to be submitted along with the PAN card application form, whether Form 49A(for Indian person or entities)or Form 49AA(for foreign persons or entities).The requirement for document depends largely on the applicants themselves.

An address proof which can be a copy of any one of the following:

- Electricity, landline or broadband connection bill

- Postpaid mobile phone bill

- Water bill

- LPG or piped gas connection bill or Gas Connection book

- Bank account statement

- Credit card statement

- Deposit account statement

- Post Office account Passbook

- Passport

- Voter’s ID Card

- Driving License

- Property registration document

- Domicile certificate issued by the Indian Government

- Aadhar Card

- Original certificate from the employer provided that the employer is a reputed public or private corporation

Date of birth proof which can be a copy of any one of the following:

- Birth certificate which is issued by the Municipal Authority or any authorized authority

- Matriculation certificate

- Pension Payment order

- Passport

- Marriage certificate issued by Registrar of Marriages

- Driving license

- Domicile certificate issued by the Indian Government

- An affidavit sworn before a magistrate stating the applicant’s date of birth

For a Hindu Undivided Family (HUF)

- An affidavit issued by the Karta of the HUF stating the name, address and the father’s name of every coparcener as on the date on which the application is made.

- Identity proof, address proof and date of birth proof as in case of an individual for the Karta of the HUF.

- Copy of the certificate of registration issued by the registrar of firms or limited liability partnerships.

- A copy of the Certificate of Registration issued by the Registrar of Firms or Limited Liability Partnerships.

- A copy of the Partnership Deed for an association of persons .

- Copy of agreement/certificate of certificate of registration number issued by a charity commissioner. for an association of persons

- Copy of Agreement/certificate of registration number form registrar of co-operative society or charity commissioner or other or any document issued by central/state for individual who are not Indian citizens.

- A proof of identity which can be any one of the following:

- Passport

- Copy of PIO card issued by the Indian Government

- Copy of OCI Card issued by the Indian Government

- Copy of other national or citizenship Identification Number or TIN attested by applicable ‘Apostille’, Indian Embassy, High Commission or Consulate where the applicant is based.

- Copy of other national or citizenship Identification Number or TIN attested by relevant ‘Apostille’, Indian Embassy, High Commission or Consulate

- Copy of bank statement of the residential country

- Copy of NRE bank statement in India

- Copy of resident certificate or Residential permit

- Copy of registration certificate issued by FRO

- Copy of VISA granted and appointment letter from any Indian company

How to Apply for a PAN Card Online on NSDL Website

If you are applying for a new PAN card, you will have to fill in Form 49A or 49AA depending on whether you are an Indian citizen or a foreign citizen. Keep in mind that is primarily for applicants who don’t currently have a PAN card and have never applied for one. Here are the steps to follow:

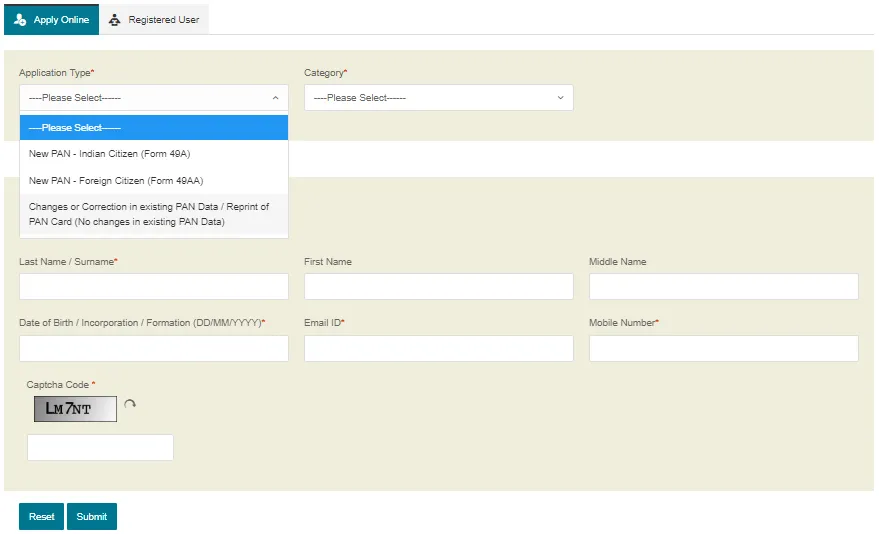

Step 1: Visit the NSDL website's Online PAN Application section

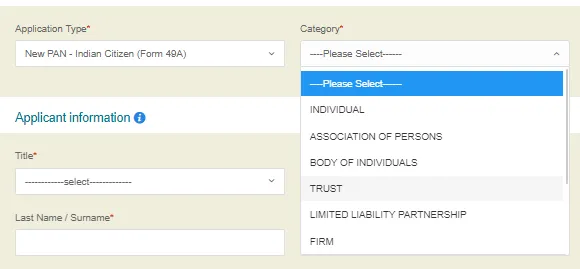

Step 2: Select your application type: your application typr; Form 49A (Indian Citizens) or 49 AA (Foreign Citizen) or Change or correction PAN/Reprint of PAN card.

Step 3: Select your Category. The options are Individual, Association Persom, Body of Individuals, Trust limited Liability Partnerships, firms, Government Hindu Undivide Family, Artificial Judicial Person and local Authority.

Step 4: Fill in the Title Last name/ surname, First name ,Middle Name, date of birth/incorporation/formation in DD/MM/YYYY format, email id, email ID, mobile number, and captcha code. Submite the form.

Step 5: On the next page you will receive an acknowledgement with a token number. Click on continue with PAN Application Form on this page.

Step 6: : you will be directed to fill in more personal details similar to Form 49A or 49AA. Input all the necessary information.

Step 7: Choose how you want to submit the document you can:a)forward application documents physically ;b) submitting digital through digital signature ;c) submit digitally through e-sign.

Step 8: on the same page, indicate what documents you are submitting as proofd for identity, address, and date of birth. Confirm the declaration, place and of application. Review and submit the form. Make sure make no mistakes.

Step 9: click on proceed and you will be taken to payment options. Choose between Demand Draft and online Payment through bill desk.

Step 10: if you choose demand draft ,you will have had to make a DD before you begin the application process as you to provide the DD number, date of issue, amount and he name of the bank from where DD is generated on the portal.

Step 11: if you choose Bill Desk, you can pay through Net Banking, and Debit or Credit Cards.

Step 12: click on I agree to terms of services and proceed to pay. The PAN application fees will vary based on whether you are sending documents separately to NSDL or uploading online.

Step 13:if you pay by using your credit card or debit card or via net banking, you will receive an acknowledgement receipt and payment receipt. Print the acknowledgement receipt.

Step 14: Attach two recent photographs with the acknowledgement receipt.

Note: Do not staple or clip the photos. Ensure that you sign across the photo that you attach on the left side of the receipt Do not sign the photo o the right Ensure that your signature is within the box provided. If you use your left thumb impression, ensure that it is attested by a gazette officer or a notary.

Step 15: After payment is confirmed send the supporting documents via post or courier to NSDL.

Once your document are received NSDL will process your application if you provided your office address as your preferred address for communication you will also need to submit proof of office address along with your residential address proof.

CONCLUSION

Hence, from the above instances, we can say that PAN Card is one of the very important documents. In today’s world, one cannot survive without a PAN Card because it is used in everything these days. It works as an identity proof for people. So, everyone who is eligible for PAN Card must apply for it otherwise one will have to pay the consequences of it.