Overview

Registration is the most common step in any tax system for the identification of taxpayers in the economy. What really GST means is the registration of any business entity to obtain a unique number from the concerned tax authorities for the purpose of collecting ta. It is very much compulsory to get registered. An individual cannot collect tax from his customers nor claim any input tax credit of tax paid by him in anyways.

In the case of GST rules, it is mandated for a business that has a turnover of above Rs.40 lakh to register as a normal taxable entity, this is referred to as the GST registration process by way of demarcation. There is a limit set for those whose turnover is Rs.10 lakh for businesses that are present in hill states or in the North-Eastern states of India. There is a time duration for the GST registration process. It needs to complete within 6 working days.

There is a portal for GST registration and this can be easily done on the online GST portal. A form is available and the business owners can fill the form on the GST portal and submit the necessary documents that are required for registration. It is very necessary that businesses must complete the GST registration process within time. This is a criminal offence that carries out operations without registering for GST. There is hefty penalties are for non-registration.

Components

There are several components:

- This would be levied by both the central and the state government.

- The dual GST can be categorized as the Central GST (CGST), State GST, Union Territory GST or the Integrated GST.

Input Tax Credit

The tax benefit is a much-known term for each person the Input Tax Credit is the tax that a business pays on a purchase. This can be used to reduce its tax liability when it makes a sale. In general, businesses can reduce their tax liability. This can be done by claiming credit to the extent of GST paid on purchases. This new concept of Goods and Services Tax is an integrated tax system. Each and every purchase by a business should be matched with a sale by another business.

GST Registration:-

This is a demarcation set by the government that all the businesses supplying goods whose turnover exceeds INR 40 lakh in a financial year are required to register as a normal taxable person whose income is this much. There is an upper limit of Rs.10 lakh. If anyone is having a business in the northeastern states, J&K, Himachal Pradesh, and Uttarakhand come under the ambit.

The limit varies as the turnover limit is Rs 20 lakh. For special category states, Rs. 10 lakh, is fixed for the service providers.

There is a list of GST registration and is mandatory irrespective of their turnover. Some of them are:

- Input Service Distributor also called ISD

- In the case of a Non-resident taxable person

- For Inter-state supplier of goods and services

- For the supplier of goods through the medium of e-commerce

- Any of the service provider

- They are liable to pay tax under the reverse charge mechanism

- Deductions such as TDS/TCS

- For the online data access or retrieval service providers

Liability to register under GST

Talking about GST being a tax in form of supply, every supplier needs to get themselves registered. There is an exception to the small businesses having aggregate turnover below Rupees 20 lakh. This turnover is divided as 10 lakh if business is in Assam, Arunachal Pradesh, Himachal Pradesh, Uttarakhand, Manipur, Mizoram, Sikkim, Meghalaya, Nagaland or Tripura then in that case there is no need to register. Any small businesses who are having turnover below the threshold limit, if thinks to file can voluntarily opt to register themselves.

GST Tax Rates

There are GST tax rates as with respect to various things such as:

· There are several items that comes under basic necessities and these items of basic necessities come under exempted list or they are not taxed.

· There are various household necessities and life-saving drugs that are too very necessary they are taxed at 5%.

· Other items like products like computers and processed food are taxed at 12%.

· Items such as hair oil, toothpaste and soaps, capital goods, industrial intermediaries and services are taxed at 18% of tax.

· As there are some items that are considered to be luxuries and are taxed at 28%.

There is a site where one can go and check various tax rates for all the products here:

There are various techniques to check out the calculation of GST which comes in handy to calculate the Goods and Service Tax using different slabs provided by the government.

GST Return

The term return in itself talks about something in return, so the GST return is a document containing details of all income, sales or expensive purchases which a taxpayer is required to file with the tax administrative authorities. These are used by tax authorities to calculate net tax liability.

For GST, a registered dealer or the person having GST number has to file GST returns that broadly include:

a) Purchases

b) Sales

c) Output GST

d) Input tax credit

For filing, GST returns one should check out this is the website that allows the import of data from various ERP systems. And such systems are Tally, Busy, custom excel, to name a few. One is given the option to use a desktop app for Tally users to directly upload data and filing of there taxes.

GSTIN (Goods and Services Tax Identification Number)

There was a time when several taxes were imposed. Before coming of GST and its implementation. The dealers of any service provider who are registered under the state this is unique number assigned to one. For the service providers, they were assigned a service tax registration number by the Central Board of Excise and Custom for their further use.

For GST, a registered dealer or the person having GST number has to file GST returns that broadly include:

In the era of GST when moving forward, all registered taxpayers will get consolidated into one single platform for compliance and administration purposes. They will be assigned registration under a single authority in itself. In totality, it is expected that 8 million taxpayers will be migrated from various platforms into the GST system.

The businesses registered will be assigned a unique Goods and Services Tax Identification Number or in short, it is mentioned as GSTIN. Verification of GSTIN can be done on the GST Portal.

GSTN or Goods and Service Tax Network

This GSTN or Goods and Service Tax Network is a non-profit, non-government organization, this will manage the entire IT system of the GST portal. For the government, it is a very useful portal as the government will use this portal to track every financial transaction and provide taxpayers with all services required.

Document required for G.S.T. Registration:

The list of documents required for registration of GST for various business are as follows:

Proprietorship

· For this, there is need of a PAN Card and address proof of proprietor

LLP

· In his also PAN Card of LLP

· There must be LLP Agreement

· Partners’ names and address proof must be attached to it.

Private Limited Company

· Attachment of certificate of Incorporation

· PAN Card of Company

· Articles of Association of the company

· Memorandum of Association, of the company

· Resolution signed by board members of the company

· Identity and address proof of directors

· Digital Signature

The following mentioned below can be shown as proof of address of a director:-

· Passport

· Voter Identity Card

· Aadhar Card

· Ration Card

· Telephone or Electricity Bill

· Driving License

· Bank Account Statement

Process of GST Registration

Preparation of GST application

There are various representatives for GST collection. They collect all the required documents and process the GST application through the iCFO platform only.

Application Filing

With the filling of all the documents, the application will be processed and filled. Then immediately the ARN number will be issued for further process.

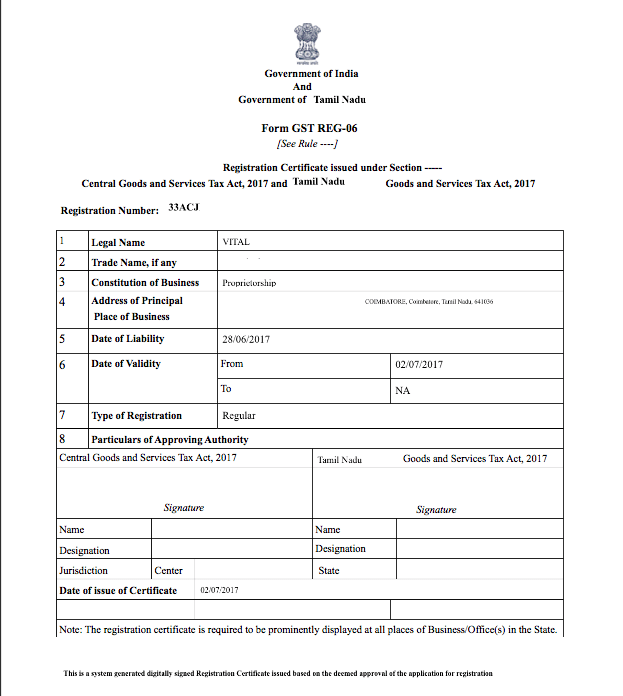

GST Registration Certificate

There is a mandatory process of the GST registration certificate and GSTIN will be issued upon verification of GST application and other mandatory documents by the GST officer. One should be aware that no hard copies of the certificate will be issued as the GST registration certificate can be downloaded from the GST Portal in itself.

Penalties for Failure to GST Registration

According to Section 122 of the CGST Act, in India, there is a direct penalty for all those taxable persons who fail to register for GST.

Voluntary Registration under GST is for Companies with a turnover below Rs.20 Lakhs.

It is referred in sense of any small business those having turnover of less than 20 lakh can voluntarily register for GST. This process is even though it is not compulsory by law.

Advantages of voluntary GST registration of them are:

· Take input credit: There is a flow of input credit right from manufacturers of the goods to the consumers of that good. Referring to Input credit it means a taxpayer while paying tax on output can deduct the tax that has already been paid. Voluntarily registered businesses can increase their margins and profits by this process.

· Is there any rule for inter-state selling with no restrictions: SMEs can increase the scope of their businesses by exploring online platforms

· Register on e-commerce websites: SMEs can widen their market for their business.

GST Return Filing

Any type of business that is registered under GST has to file returns monthly, quarterly and annually based on the category of their business. It is to be done through the portal of Government of India GST portal. There is a need to provide the details of the sales and purchases of goods and services along with the tax collected and paid.

Taxpayers have services such as registration, returns, compliance that are transparent and straightforward. There are four forms for Individual taxpayers for filing their GST returns such as the return for supplies, return for purchases, monthly returns, and annual return. Small taxpayers who have opted for a composition scheme will have to file quarterly returns, all these filings of returns will be done in online mode only.

Physical verification in connection with the registration procedure

When it is so very much necessary then only physical verification is to have resorted to the subjective satisfaction of the proper officer. In the process of registration, if it is felt necessary, it will be undertaken only after granting the registration and the verification report with the supporting documents and photographs. These all shall have to be uploaded on the common portal within the specified period of fifteen working days.